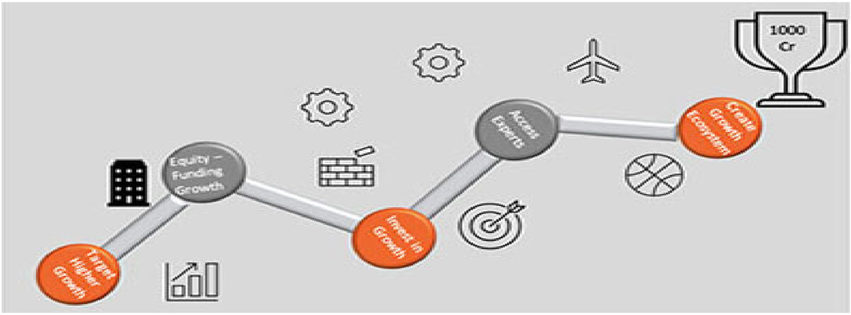

5 Steps to becoming a 1000cr company

Ambition leads to success and growth. Large companies look at even larger companies and want to get there. Startups want to be Unicorns. SMEs in India should aim to be a “1000 Cr Company”.

In this environment of Volatility, Uncertainty, Complexity and Ambiguity (VUCA) it is either Growth or Extinction!!

Learn from large corporations and Startups to put yourself on the path to annual revenue of 1000 Cr.

1.Growth Percentage

Large Companies: Record high revenue growth on an ever-expanding base. Their focus on continuous growth enables them to aim bigger and better.

Start-ups: Call themselves the future unicorns and believe that they are large companies waiting to happen.

SME: Need to “Believe” and target for 30-50-100% growth YOY as the base is relatively small. Aim to outperform the industry standard for growth as yours is a smaller base. The scope for accessing new markets are much higher for SMEs.

2.Invest vs. Spend

Large Companies: Focus on maximising scale by investing in market penetration, product development and diversification.

Start-ups: Invest heavily on two key areas fundamental for growth – product development and brand building.

SME: Invest in Growth areas. Do not bucket investment under expenses. The saving mind-set, taken too far, can curtail growth. Planned investments in growth factors like customer acquisition will propel the organisation into a different trajectory.

3. Equity Financing vs. Debt Financing

Large Companies: Opt for equity as they prefer creating more owners, bring in more knowledge, share the risk as well as the returns. In return, they are happy to share ownership and profits.

Start-ups: Equity financing is the only viable option as VCs and angel investors enter at a low cost and even if 10% of the start-ups succeed, they get a high return on investment as their entry cost was low.

SME: Debt makes you risk averse and reduces your ability to innovate and grow. Equity, well managed, has a history of adding great wealth to the organisation as well as to the personal wealth of the entrepreneur. Make sure you look attractive to investors.

4. Do it Yourself vs. Go to experts

Large Companies: Bring in experts from all fields and achieve a common objective of making the company a success.

Start-ups: Tend to always be in the “seek help” mode. From funding to professional support from the industry experts.

SME: Bring in expertise into the company. Much before you are a 1000 Cr company, you need to think like a 1000 Cr company. Innovative models of engagement help you, access experts, globally. Startups prove that you don’t need very very deep pockets to access experts. Access experts, remove the nagging fear of money going down the drain. Learning things at your own expense through DIY models wastes both money and time on trial and error. Opportunities don’t knock all the time. Hire the best.

5. Create an ecosystem for success: Collaboration Vs Hard Negotiation

Large Companies: Less of a standalone entity, larger companies believe in having a seamless network of partnerships and alliances with vendors to create an ecosystem for success. This helps in accessing the best resources and skills for the long term and earns the commitment of the partners.

Start-ups: Target only the best vendors for their support – often they don’t have the funds. They use personal contacts, social media, mentoring relationships, flexible outsourced models, board positions and other innovative means to access expertise.

SME: Do not try to squeeze the pricing of vendors to the extent that they lose interest in supplying to you. This short term “saving” ends up being loss-making for the SME who then end up being supported by “bottom scraping” vendors who cannot help them grow. Create a Win-Win relationship with your partners and Vendors. Ensure that they grow as you grow. Carry your ecosystem with you.

Reasons why SMEs should aim for more than Large Corporates and Start-ups:

1.Proven Business Model: SMEs plan their growth and sell profitably and are sound businesses. They are not dependent on that elusive funding that Startups depend on. Investors can the status of the company and its profitability.

2.Scope for Growth: SMEs have a larger scope for growth as they can go deeper into the markets whereas large companies due to high overheads are restricted to large cities. SMEs are the true beneficiaries of the famous “Demographics Dividend” of India.

3.Speed of Decision-making: SMEs are more agile, hence speed up the process of making decisions. Large corporations, with their geographical spread and bureaucracy, often take much longer in making decisions.

4.ROI orientation: SMEs are more focused on ROI and hence allocate budgets correctly with clear objectives.

5.Smaller organisations are easier to pull in one direction: The staff in a large corporation is less likely to understand the model of the entire business. Thus, people are specialised and not focused on the larger goal. Every employee working in an SME understands the business model to create, develop and deliver value to the customers. Leadership connect helps infuse the entire organisation with energy to pull in one direction.

Aaroh is a leading global consulting firm providing SMEs a broad range of services to redefine their approach to their business operations. We enable SMEs to derive scale using the growth triad of Marketing, Technology and Finance.

© 2024 – Aaroh Consulting