CFO On Demand

CFO On Demand

CFO on Demand

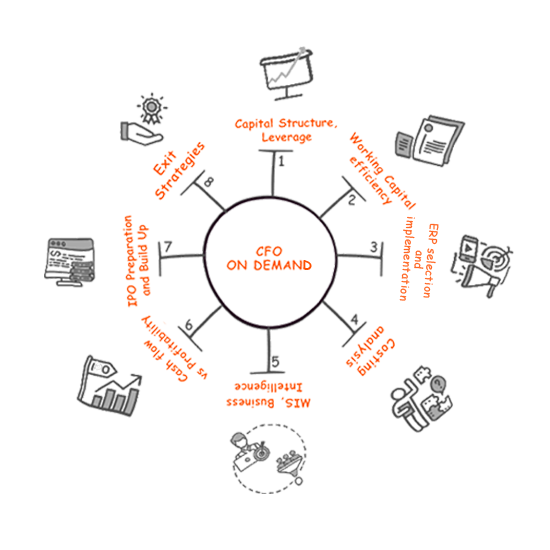

Reviewing capital structure, Working capital efficiency, cost structures, putting in place SOPs and MIS dashboards, enabling business intelligence for data based decision making for leaders – these are some of the functions of the CFO on Demand. Regular review of data and intelligence for business leaders. The following framework is used to achieve business objectives:

MIS, reliable, consistent and Insightful

Understanding drivers of business like topline drivers, cost drivers, working capital drivers and cash flow drivers and getting in depth on each of the drivers

Cashflow – understanding cash flow cycles, working capital cycles, looking for potential blockages and leakages to ensure free flow of cash

Training and bringing the staff upto speed with modern practices

Ensuring compliance

In addition, CFO on Demand can have a business partner role to ensure Capital is efficiently used and the vision of the Promoter is realised.

Capital Structure, Leverage

Capital structure and leverage play an important role in a company’s ability to scale up and grow. Requirement of external funds and a decision to create a mix of tools in line with objectives and usage of these funds often define how efficiently the company is able to meet its objectives. Debt has been the preferred route for most SMEs and Equity has been shunned. In this day and age of evolving financial instruments, debt restructuring has been explored by few SMEs.

Aaroh helps companies to arrive at an ideal capital structure which includes the company’s long and short-term debt, common and preferred stock. This is done in line with the company’s objectives and business plan to enable the optimum usage of financial instruments available. It helps present a healthy and robust financial model for future requirements and to improve the credit rating of the company. We can help with understanding how a banker (lender) evaluates a credit proposal and how to prepare for the same as well as understand various drivers of credit score, credit appraisal, etc. In Equity, understanding the valuation, its drivers, terms of dilution, etc. are critical to ensure that value is optimised.

Working Capital efficiency

Efficient management of working capital is essential to a company’s fundamental financial health and operational success as a business. This is one among the top 3 reasons for blockages and leakages that affect profitability severely in SMEs. In order to eliminate blockages & leakages and overall health of the company, organisations need to have clear understanding of receivable and payables, duration for each, inventory management for raw materials, WIP and finished goods. CFO on Demand helps with streamlining the process of maintaining stock and visibility of stocks at all levels to enable decision making and quick action based on the information to ensure that the organisation is able to plug in leakages due to overstocking or understocking at any stage of the production process. Overall vision is to ensure that cash is flowing without any interruptions and the cycles are smooth and fast.

Functional support for ERP selection and implementation

Today more than 60% of ERP implementations are either failed, delayed or end up giving only sub-optimal results than what was envisaged due to either wrong solution or incorrect implementation.

There are multiple options available which helps streamline the accounting and production processes. Detailed assessment is required to determine the suitability of the solution. This requires a study of existing processes, databases, challenges in terms of reporting and operations. We also need to align the solution with the growth plans of the entity. Implementation partners generally have a view of their own solution and not a 360 degree view of the entity and other solutions used by them. Aaroh partners with SMEs to do the assessment from internal process/suitability as well as various options available. Besides selection, implementation requires functional experts to design the system, workflows, revenue/cost centers and chart of accounts to ease the workflow, reduce manual work to ensure that the system is optimised. Also integration of ERP with other banking, supply chain and online marketplace systems through API can be enabled using the tools available without any disruption.

Costing analysis – Optimisation of direct and indirect costs

Comprehensive cost analysis and attribution of costs to products and services are often not done accurately in SMEs giving inadequate understanding of cost of producing or serving a customer. Margin calculations therefore become inadequate and all the MIS that follows doesn’t give the correct understanding of the strengths and weaknesses of the business. Individual costing of raw materials, analysing them periodically to ensure that SMEs are tapping the most cost efficient vendors and suppliers – this is important for organisations to manage costs. CFO on Demand helps with this process and puts in place detailed MIS to keep costs in control and prevents costs from escalating.

MIS, Business Intelligence

Data driven decision making is the primary requirement of a growing business. CFO on Demand helps SMEs create MIS dashboards using data in any format that is already available within the organisation in its current state.

Business intelligence facilitates the collection, integration, analysis, and presentation of business information that support better decision making. Tools help to create value from large pools of everyday data like sales, manufacturing, SKUs movement, etc. It enables advanced analytics, customized dashboards with canned templates, information infrastructure, query options, reporting and analysis. This information available to the leaders on a daily basis helps take decisions that can turn the fortune of most companies to create higher profits and long term wealth. Integration of MIS and BI tools with other business solutions ensure that data is consolidated and presented in a predefined manner on a daily/weekly/monthly basis to enable fact based decision making rather than decision making based on hunches or incomplete information which is very common with SMEs.

Cash flows vs Profitability

Most SMEs do not have clear, month on month understanding of profitability. As long as entrepreneurs have enough money to meet expenses month on month, very often they are not tracking profitability.

Anything that doesn’t get tracked and measured doesn’t improve. Wealth creation is a function of profitability and every organisation should aim to improve profitability year on year. Positive cash flows ensure you keep operating your business from day to day. Increasing profitability enables wealth creation and expansion. Calculation of profits should also be done on predefined models for cost calculation which should remain consistent year on year like in large organisations. This gives a strong financial discipline required for building an organisation at scale. Aaroh’s CFO on Demand works with internal finance teams to bring rigour and discipline to tracking and reviewing all relevant metrics consistently and regularly to enable improved bottom lines and create real wealth.

IPO Preparation and Build Up

CFO on Demand will help you to start operating like a public company well in advance. Focus on corporate governance appropriate for a public company and develop a culture of compliance. Work with the legal team to adopt state-of-the-art corporate policies and codes of conduct. Discuss with your advisors any “material weaknesses” or “significant deficiencies” in your internal financial controls and understand their impact on your SEBI review. Inconsistent approach to accounting and reporting over consecutive years means that SMEs are often not compliant with SEBI guidelines for listing.

CFO on Demand will help you to identify gaps and create transition models to be ready for the SEBI guidelines and reviews over a period of 2- 3 years. IPO preparation is a very exhaustive process and CFO on Demand ensures that you are aligned to the guidelines required for the same by SEBI and the stock exchanges like BSE SME and NSE.

Exit Strategies

Succession planning is a challenging situation for most aging founders. Very often SME leaders do not prepare for succession and are often expecting their next generation to take over leadership positions automatically. More and more, the next generation has different ideas and even if they are joining, they want to professionalise the management to decrease complexity. When the next generation doesn’t agree to join full time, families need to opt for exit strategies which enable them to keep their interest in the company while transferring day to day decision making, operations and sometimes even majority control to other individuals. Aaroh can help manage this process professionally through the following routes:

Merger: two businesses combine into one

Acquisition: when a company buys another business

Sell to someone you know. You may want to see your business live on under someone else’s ownership

Initial public offering

Liquidation

Aaroh is a leading global consulting firm providing SMEs a broad range of services to redefine their approach to their business operations. We enable SMEs to derive scale using the growth triad of Marketing, Technology and Finance.

© 2024 – Aaroh Consulting